FINANCIAL INCLUSION

FINANCIAL inclusion is the delivery of FINANCIAL services at affordable costs to vast sections of disadvantaged and low income groups.

History evolution of Financial inclusion

Policy makers have grapped with the issue of reducing the scope of informal sector since colonial times .

Nicholson report (1895) was the first to highlight the need to establish “LAND BANKS” as an alternative to dominace of money lenders . resulting , the cooperative credit socities Act , 1904 was passed to provide , amongst other things , a legal basis for cooperative credit socities .

Even after 70 years of independence, a large section of Indian population still remain unbanked.This malaise has led generation of FINANCIAL instability and pauperism among the lower income group who do not have access to FINANCIAL products and services.

Historical Perspective

- 1954 : All-India Rural Credit Survey Committee report -suggested Multi-agency approach for financing the rural and agricultural sector;

- 1963 : Formation of Agricultural Refinance Corporation

- 1969: Nationalization of 14 major Private Banks – The flow of agricultural and rural credit witnessed a rapid increase

- 1972–Mandatory system of Priority Sector Lending (PSL)

- 1975 : Establishment of RRBs

- 1980 : Nationalisation of 6 more private banks

- 1982 : Establishment of NABARD through the transfer of RBI’s agricultural credit department Provision of bank credit under Govt. Sponsored Subsidy Schemes Linking Agricultural Credit Targets at 18% with individual bank’s net bank credit

- 1990–Implementation of the concept of Village level credit planning for 15 to 20 villages allotted to each of rural, semi-urban and urban branches of PSBs and RRBs under Service Area Approach

- Formulation of potential linked credit plan for each district annually by NABARD

- Agricultural Debt Relief Scheme and Financial Sector Reforms

- SHG-Bank Linkage as the most suitable model in Indian context a/c to NABARD

- 2000-Reforms sharply focused on Agricultural credit

- doubling the flow of agricultural credit – implementation of agricultural credit package

- Annual Special Agricultural Credit Plan

On tracks _ of NDA govt ..

Financial inclusion is expected to make signifcant changes in the economy , especially the rural economy , which is expected to witness a revolution in availability of financial instruments mainly because of —

- PMJDY (As of Union Budget February 2019, there are 34 crore Jan Dhan Yojana beneficiaries)

- gold monetization scheme

- MUDRA

- DBT

which will operate through the banking system will also ensure regularity of flow of liquidity in housholds and therefore opportunities for investment.

Why FINANCIAL Inclusion in India is Important ?

The policy makers have been focusing on FINANCIAL inclusion of Indian rural and semi-rural areas primarily for three most important pressing needs.

- Creating a platform for inculcating the habit to save MONEY – The lower income category has been living under the constant shadow of financial duress mainly because of the absence of savings.

2.Providing formal credit avenues – So far the unbanked population has been vulnerably dependent of informal channels of credit like family, friends and moneylenders. Availability of adequate and transparent credit from formal banking channels shall allow the entrepreneurial spirit of the masses to increase outputs and prosperity in the countryside.

3.Plug gaps and leaks in public subsidies and welfare programmes – A considerable sum of money that is meant for the poorest of poor does not actually reach them. While this money meanders through large system of government bureaucracy much of it is widely believed to leak and is unable to reach the intended parties. Government is therefore, pushing for direct cash transfers to beneficiaries through their BANK ACCOUNTS rather than subsidizing products and making cash payments.

What are the steps taken by RBI to support FINANCIAL inclusion?

A.Initiation of no-frills account – These accounts provide basic facilities of deposit and withdrawal to accountholders makes banking affordable by cutting down on extra frills that are no use for the lower section of the society. These accounts are expected to provide a low-cost mode to access BANK ACCOUNTS. RBI also eased KYC (Know Your customer) norms for opening of such accounts.

B. Banking service reaches homes through business correspondents – The banking systems have started to adopt the business correspondent mechanism to facilitate banking services in those areas where banks are unable to open brick and mortar branches for cost considerations. Business Correspondents provide affordability and easy accessibility to this unbanked population. Armed with suitable technology, the business correspondents help in taking the banks to the doorsteps of rural households.

C.EBT – Electronic Benefits Transfer – To plug the leakages that are present in transfer of payments through the various levels of bureaucracy, government has begun the procedure of transferring payment directly to accounts of the beneficiaries. This “human-less” transfer of payment is expected to provide better benefits and relief to the beneficiaries while reducing government’s cost of transfer and monitoring. Once the benefits starts to accrue to the masses, those who remain unbanked shall start looking to enter the formal FINANCIAL sector.

What more is to be done for FINANCIAL inclusion?

FINANCIAL inclusion of the unbanked masses is a critical step that requires political will, bureaucratic support and dogged persuasion by RBI. It is expected to unleash the hugely untapped potential of the bottom of pyramid section of Indian economy. Perhaps, financial inclusion can begin the next revolution of growth and prosperity.

India had scored poorly on financial inclusion parameters when compared with the global average

as per Reserve Bank of India in its annual report

The report quoted a World Bank study in April 2012, which had shown half of the world’s population held accounts with formal financial institutions. The study said only nine per cent of the population had taken new loans from a bank, CREDIT UNION or microfinance institution in the past year. In India, only 35 per cent have formal accounts versus an average of 41 per cent in developing economies.

*India also scored poorly in respect of_

- CREDIT CARDS

- Outstanding mortgage

- Health insurance

- Adult origination of new loans and mobile banking.

Intiatives by RBI __

- BCs — 110,000 business correspondents employed through the business facilitator and business correspondent (BC) models and set up goals for banks to provide access to formal banking to all 74,414 villages with population over 2000.

- RBI also adopted the information, communication, technology-based agent bank model through BCs for door-step delivery of financial products and services since 2006

- Minimum infrastructure for operating small customer transactions and supporting up to 8-10 BCs at a reasonable distance of 2-3 km.

FINANCIAL INCLUSION & RURAL CREDIT

Overview

- French proverb rightly stresses the urgency of Credit to the farmers “Credit supports the farmer as the hangman’s rope supports the hanged”

- RBI estimates : 40% of the Indians do not even have a bank account.

- Sources of credit for cultivator households

- 27% of the households from formal sources

- 22% from informal sources

- 51% with virtually no access

Mico-Finance Services

- credit / savings

- insurance,

- pension services,

- money transfer,

- Leasing

- issue / discount of warehouse receipts and future / option contracts for agricultural commodities and forest produce.

Indices

- Index of Financial Inclusion (IFI) : Kerala -> MH -> Karnataka-> Bihar

- Micro-finance Penetration index(MPI)

- Micro-finance Poverty penetration index(MPPI)

- Even states like Gujarat and MH lag behind the national average of 40.1%

- Short-term loans for (working capital) cultivation of all crops of economic importance;

- Long-term loans for the development of irrigation potential, purchase of farm equipment and machinery, Land Development, Plantation crops and horticulture,Sericulture, hi-tech agriculture, Cold-storage and market yards

- There has been a growing realization that the needs of rural credit cannot be adequately served by the use of large financial institutions such as commercial banks; the micro information that is required for these operations precludes efficient market coverage on the part of these organizations. Two kinds of policies can arise in response:

- To recognize explicitly that informal lenders are much better placed to grant and recover loans from small borrowers than formal institutions; The idea then is not to try to replace this form of lending but to encourage it by expanding formal credit to economic agents who are likely to use these funds in informal markets

- To design credit organizations at the micro level that will take advantage of local information in innovative ways

- Credit removes financial constraints and accelerates the adoption of new technology and hence agricultural modernisation

Financial inclusion & Institutional Structure & Mechanisms

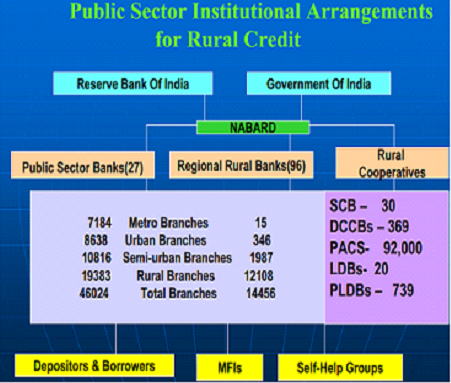

- Institutional Structure of Rural Banking includes & Formal : (direct/indirect & short-term/long-term)

- RBI – regulator of SCBs

- NABARD: (re-financing)

- Commercial Banks – Credit Disbursal

- Local Area Banks (LABs) – their geographical spread is constrained to few districts; Private in nature

- RRBs – Credit Disbursal — Equity holdings of __

Central Govt. : State Govt. : Sponsoring Bank = 50 : 15 : 35

- Cooperatives – Credit Disbursal

- 3-tier Cooperative Credit Delivery (Short-term Credit)

- PACS – Primary Agricultural Cooperative Societies; 40.74% if PACS were loss-making; Village/PACS ratio – 7.8

- DCCB, SCB,MFIs,SHGs

- PCARDBs – Primary Cooperative agricultural and Rural Development banks

- SCARDBs – State Cooperative agricultural and Rural Development banks

- They belong to both money market and capital market and offer both short-term and long-term loans. SCBs and some UCBs(Urban cooperative banks) are scheduled banks.

- Land Development Banks – Credit Disbursal

- National Scheduled Tribes Finance and Development Corporation (NSTFDC)

- The National Scheduled Castes Finance and Development Corporation (NSCFDC)

- National SafaiKaramcharis Finance and Development Corporation (NSKFDC)

- National Backward Classes Finance and Development Corporation (NBCFDC)

- National Minorities Development and Finance Corporation (NMDFC)

- North-East Development Finance Corporation Ltd

- Credit extended by banks through Govt. employment generation programmes: also involves an element of govt. subsidy

- Swarnajayanti Gram SwarozgarYojana (SGSY)

- Prime Minister’s RozgarYojana (PMRY)

- NBFCs and NGOs

- Informal :Money-Lenders, Friends and Relatives

Trends

- Agricultural credit (Loan amount : Commercial banks > Cooperative banks > RRBs);

- Domination of Cooperative banks in credit disbursement till 2000 is being replaced by Commercial banks (as % of total credit);

- 1993 : Cooperatives – 61% ; Commercial banks – 32.7%; RRBs – 5.9%

- 2000 : Cooperatives – 37.9% ; Commercial banks – 54.1%; RRBs – 7.8%

- 2012 : Cooperatives – 18.3% ; Commercial banks – 71.2% ; RRBs – 10.5%

- But, in terms of number of agricultural credit accounts, the STCCS(Short-term cooperative credit structures) has 50% more accounts than the commercial banks and RRBs put together.Directly or indirectly, it covers nearly half of India’s total population

- Kisan Credit Card Scheme (No.of cards : Commercial > Cooperative > RRBs ; Amount sanctioned : Commercial > RRBs > Cooperatives)

- of SHGs served and loan amount : Commercial Banks > Cooperative banks > RRBs

- Category of Farmers served by Commercial Banks : Wide gap exists between the Loan Accounts and Credit Disbursal to Small, Medium Farmers and Big Farmers (> 5 acres)

- Increasing Trend in the flow of indirect financing (Not a direct credit disbursal, but through Micro-credit channels)

- 196 RRBs have been under the process of amalgamation since 2005 and their number have been reduced to 64 in 2013;

Essential Elements of Rural Credit

- Credit can neither be cheap and facile nor on easy terms without regard to its use, but it should be guarded, guided and productive

- Credit institution should have tailor-made loan products to match the specific needs of target groups

- Loans must be linked to credit-worthiness of the purpose rather than to the credit-worthiness of the Person

- Approach, Attitude and Management style must be conducive to the genius and ethos of rural areas – Effective communication helps to deal with rural clientele and earn their confidence

- Financial Literacy and Credit counseling of Farmers

- policy must focus on promoting recovery climate and in no case should vitiate the recovery climate

Financial Inclusion Strategies

- BC-model

- PoS(Point of Sale)

- No-frills accounts (With very little or no minimum balance), simplification of KYC norms

- KCC – Kisan Credit Card – from the year 1998-99 –to meet production credit requirements and short-term credit needs in a timely and hassle-free manner credit for crop production

- Lead Bank Scheme -1969 aimed at forming a coordinated approach for providing banking facilities. To enable banks to assume their lead role in an effective and systematic manner, all districts in the country (excepting the metropolitan cities of Mumbai, Kolkata, Chennai and certain Union Territories) were allotted among Public Sector Banks and a few Private Sector Banks The Lead bank role is to act as a consortium leader for co-coordinating the efforts of all credit institutions in each of the allotted districts for expansion of branch banking facilities and for meeting the credit needs of the rural economy. For the preparation of District Credit Plans and monitoring their implementation a Lead bank Officer (LBO) now designated as Lead District Manager was appointed in 1979

- Local Area Banks (1996) –are expected to bridge the gap in credit availability and strengthen the institutional credit framework in the rural and semi-urban areas Although the geographical area of operation of such banks will be limited, they will be allowed to perform all functions of a scheduled commercial bank Licences are given out in under-banked or unbanked areas of the country. Some of these local area banks could eventually become full-fledged banks at some stage the local area banks are likely to have a capital adequacy ratio higher than 15% to offset higher risk arising from being geographically focused.. The scheduled commercial banks are required to have a capital adequacy ratio — ratio of capital fund to risk weighted assets expressed in percentage terms — of 12%

- Swabhiman – Opening of Bank accounts covering the habitations with minimum population atleast through Business correspondent model providing cash services.Habitations with population more than 1600 in plain areas and 1000 in north-eastern and hilly states as per 2001 census are covered.

- Ultra small Branches with Bank officers offering other services , undertake field verification and follow-up banking transactions.

- Direct Benefit Transfer : Cash transfer through Aadhar payment Bridge requires Bank accounts which leads to financial inclusion.

- Interest subvention scheme : facilitates access to cheap credit from the banks indirectly through interest subsidies from the govt. It is a subsidy of interest given by Government to certain sectors like Textiles, Farm .. For eg. Textile company borrow from Bank at 10% and Government gives subvention of 2%. Hence net bank takes interest from textiles companies 8%. Other sectors have to pay 10% to the bank. Likewise, Farm or Agriculture sectors borrows from Bank at 10% and they will get 4% subvention from the govt. Certain sectors are covered by the system of Differential rate interest(DRI) which is less than base rate.Eg : Educational loans, export credit, agriculture, credit to weaker sections.

- Priority Sector Lending – target of 40% of Net Bank Credit to select few sectors for all banks including foreign private ones;

- RashtriyaMahilaKosh (RMK)- to facilitate credit support to poor women for their socio-economic upliftment;

- Dedicated bank for Women(National Bank for Women) proposed in 2013-14 budget. Objective of broadening the SHG-bank linkages.

Committee on financial inclusion

Khan Commission

RBI set up in 2004 to look into FINANCIAL inclusion and the recommendations of the commission were incorporated into the mid-term review of the policy (2005–06) and urged banks to review their existing practices to align them with the objective of FINANCIAL inclusion. RBI also exhorted the banks and stressed the need to make available a basic banking ‘no frills’ account either with ‘NIL’ or very minimum balances as well as charges that would make such accounts accessible to vast sections of the population

Of the many schemes and programmes pushed forward by RBI the following need special mention.

Rangarajan Committee

4 major reasons for lack of financial inclusion

- Inability to provide collateral security

- Poor credit absorption capacity,

- Inadequate reach of the institutions

- Weak community network

- there is need to organize Urban/peri-Urban poor people into Neighbourhood Groups (NHGs) on the same pattern as has been adopted for the rural poor.(Need to extend the mandate of NABARD to cover beyond rural areas)

- alter the emphasis somewhat from the large Bank led, public sector dominated, mandate ridden and branch-expansion-focused strategy to Micro Banks.

2nd ARC(Administrative reforms commission) on Financial Inclusion:

- Innovation is critical for financial inclusion. This would mean developing newer financial products in terms of loans, savings, insurance services etc. which are tailored to the needs of the poor.

- Currently, most public sector Banks and micro-finance institutions have a narrow product offering, which limits the choice of the SHGs and also constrains them in terms of utilizing the loans productively.

- extension of the RRB network to the remaining non-financed areas would considerably speed up the process of inclusive banking and help in extending micro-finance to local SHGs.

- high penetration of telecom connectivity in India, together with the latest mobile technology could be used to enhance financial inclusion in the country.

- MFIs should handle thrift / saving and money transfer only as business correspondents of Scheduled Banks, but not in their individual capacity as a micro-finance lender as it involves hard earned savings of the poorest of the society

4 models of SHG-Bank Linkage:

- SHG-Bank linkage promoted by a mentor institute (Eg: Self-Help Promotion Agencies & NGOs) – SHPAs provide the seed money. 2nd ARC believed that this is an appropriate model to be replicated on large scale

- SHG-Bank direct linkage – Very less frequent because of meagre initial savings of SHGs

- SHG-Mentor Institution linkage(indirect linkage) – SHPAs act as financial intermediaries. SHPI accepts the contractual responsibility for repayment of the loan to the Bank unlike in case 1

- SHG-Federation model – Cluster of SHGs forming a federation to attain economic sustainability. This federation acts as an intermediary. Some federation are even capable of accessing credit from large MFIs.

Nachiket mor commitee

Committee on Comprehensive Financial Services for Small Businesses and Low Income Households” was set up by the RBI in Sep 2013 under the chairmanship of Nachiket Mor, an RBI board member.

Key Recommendations

- Providing a universal bank account to all Indians above the age of 18 years by January 1, 2016. To achieve this, a vertically differentiated banking system with payments banks for deposits and payments

- wholesale banks for credit outreach. These banks need to have Rs.50 crore by way of capital, which is a tenth of what is applicable for new banks that are to be licensed.

- Aadhaar will be the prime driver towards rapid expansion in the number of bank accounts. Monitoring at the district level such as deposits and advances as a percentage of gross domestic product (GDP).

- Adjusted 50 per cent priority sector lending target with adjustments for sectors and regions based on difficulty in lending.

- Increase the Priority Sector Lending Mandate The Mor committee has recommended that the priority sector lending mandate for banks should be raised from the current 40 per cent to 50 per cent. At the same time, the banks must be freed from all pricing and other restrictions.

- Allow differentiated Licenses —The committee has taken ahead the case of differentiated banking licences. It has proposed that three new categories of banks viz. payment, wholesale investment and wholesale consumer should be allowed. At the same time, the regulations for non-banking financial companies, or NBFCs should be streamlined. The biggest problem here would be the business viability of such banks. One example of differentiated banking license is Regional Rural Banks, which were started off with great promises but ultimately broke down.

- Meaningful Financial Inclusion —The Nachiket Mor committee has suggested two specific district-level penetration metrics viz. the credit- GDP and life cover-GDP ratios to monitor the meaningful financial inclusion. This is a slight departure from the number of accounts formula of financial inclusion. It is a meaningful recommendation and must be taken ahead.

DEEPAK MOHANTY

The Reserve Bank of India (RBI) on 15 July 2015 constituted a committee to work out a five-year (medium-term) action plan for financial inclusion. The 14-member panel will be headed by RBI executive director Deepak Mohanty.

- The Committee will work to spread the reach of financial services to unbanked population.

- To review the existing policy of financial inclusion including supportive payment system and customer protection framework taking into account the recommendations made by various committees set up earlier.

- To study cross country experiences in financial inclusion to identify key learnings, particularly in the area of technology-based delivery models, that could inform our policies and practices.

- To articulate the underlying policy and institutional framework, also covering consumer protection and financial literacy, as well as delivery mechanism of financial inclusion encompassing both households and small businesses, with particular emphasis on rural inclusion including group-based credit delivery mechanisms.

- To suggest a monitorable medium-term action plan for financial inclusion in terms of its various components like payments, deposit, credit, social security transfers, pension and insurance.

# NOTE — there is no short cuts in learning so i provide the most and best of the part each & every point was covered , it will helpful in every ascpet of learning